Red Star Capital Bureau news on June 12, NIO announced today: From June 12, 2023, the starting price of all new NIO cars will be reduced by 30,000 yuan.

According to the NIO announcement, from June 12, 2023, the deposit will be paid to buy all NIO new cars. The first owner’s car rights will be adjusted to 6 years or 150,000 kilometers of vehicle quality assurance, and the three-power system will have 10 years of unlimited mileage quality assurance. At the same time, the free power exchange service will no longer be used as the basic car rights, and users can choose to pay for a single power exchange. NIO will then launch a flexible charging and changing service package.

According to the NIO official account

After the announcement of NIO’s price cut was released, it caused a lot of heated discussions. There are voices in the industry that the latest financial report shows that NIO is in a state of loss. Will the price cut further reduce the gross profit margin and make the loss more serious?

Red Star Capital Bureau noted that NIO’s entire system reduced by 30,000 yuan, which is different from Tesla’s previous simple price reduction. It is a package of rights and interests worth about 30,000 yuan for the new car. It is a lifetime free power exchange, vehicle quality assurance years and other rights and interests. NIO’s move will untie the rights and interests of power exchange and vehicle prices, bringing lower vehicle purchase prices.

For the vast majority of car buyers, it is a cost-effective deal to exchange 30,000 cash with the lifetime free power replacement rights 4 times a month. NIO users said that they have driven a NIO car with a 75-degree battery for one year, and they run almost 400 kilometers after each power change. The monthly power change cost is about 400 yuan, and the price reduction of 30,000 yuan is basically equivalent to the power change cost of 6 years. For users who have the conditions to install household charging piles, they can rely on low electricity prices (about 0.5 yuan/kWh for civilian valley power) to cover almost all charging needs. This 30,000 yuan is the cash saved directly.

From a financial standpoint, users were previously equivalent to paying off the rights and interests of free electricity replacement for life at one time, but NIO cannot immediately recognize this part of the amount as income, but can only amortize it over several years. In the financial report, this part of the income and gross profit cannot be visualized. Previously, NIO users had four free electricity replacement rights per month. After August 1, NIO will charge new users for electricity replacement, with an average cost of about 80-100 yuan per time, which will undoubtedly increase NIO’s income in electricity replacement. After excluding those owners who have owned cars for a long time and changed electricity a lot, the overall gross profit of NIO may increase.

Li Bin, founder, chairperson and CEO of NIO, once said: "With the delivery of higher-priced products in the second and third quarters of this year, the average transaction price and gross profit margin of bicycles will also recover. NIO is confident that it will achieve double-digit gross profit margin in the third quarter of this year and exceed 15% in the fourth quarter. At the same time, benefiting from the cost advantage brought by technology self-research and innovative supply chain, the gross profit target of the second-generation technology platform model remains at 20%."

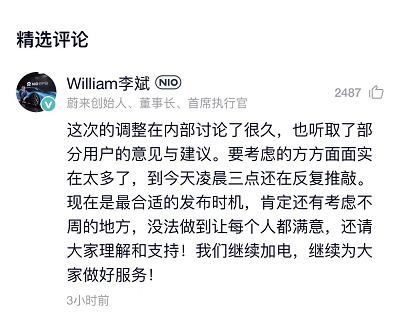

The Red Star Capital Bureau noticed that in response to the news of the price reduction, Li Bin responded on the NIO APP: This adjustment has been discussed internally for a long time, and some users’ opinions and suggestions have also been listened to. There are too many aspects to consider, and they are still deliberating at three o’clock today. Now is the most appropriate time to release, and there must be some thoughtless aspects, and it is impossible to satisfy everyone.

Screenshot from NIO APP

On the evening of June 9, NIO announced the 2023 Quarter 1 financial report. Total revenue was 10.6765 billion yuan, an increase of 7.7% year-on-year and a decrease of 33.5% month-on-month. Net loss was 4.7395 billion yuan, an increase of 165.9% year-on-year and a decrease of 18.1% month-on-month.

As of press time, NIO-SW reported HK $63.8/share, up 5.8%, and its market value 106.50 billion HK $.