CCTV News:This year, as witnesses, we cheered for the country, with vast mountains and rivers and fireworks, and China in the new era is full of vitality; In this year, as participants, we stood shoulder to shoulder with the country, overcame all difficulties, and China on the new journey bravely moved forward; A little bit of starlight, even if it is weak, together is the bright Milky Way. It is millions of ordinary people, you and I, who have finally achieved extraordinary China. Next, let’s review 2023, which is full of struggle and courage, look at the thriving land of China and feel the vitality and vitality of Chinese modernization together.

[Groups of growing economic data depict indomitable struggle China]

In the first three quarters of 2023, the gross domestic product (GDP) increased by 5.2% year-on-year, the economic aggregate grew rapidly, the growth rate remained ahead of the major economies in the world, and high-quality development was solidly promoted.

In 2023, we overcame frequent natural disasters, and the country’s grain harvest again, with a total output of 1,390.82 billion Jin, an increase of 17.76 billion Jin over the previous year, and it has been stable at more than 1.3 trillion Jin for nine consecutive years, hitting a new record high.

In 2023, global trade demand continued to be under pressure, but China’s foreign trade "new three kinds" exports still performed brilliantly. Data show that in the first 11 months of this year, China’s "new three products" such as new energy vehicles, lithium batteries and photovoltaic products exported a total of 1,014.2 billion yuan, up 30.7% year-on-year. The new growth reflects the continuous accumulation of manufacturing capacity in China, and it also shows that new advantages are constantly being formed in the high-quality development of manufacturing in China.

In 2023, we will open the market more confidently, participate more actively in international affairs, and pay more attention to safeguarding and improving people’s livelihood. On the journey of promoting Chinese modernization, China is getting better and better with down-to-earth work and perseverance.

This year marks the tenth anniversary of the "One Belt, One Road" initiative. Over the past decade, more than 150 countries and more than 30 international organizations have joined in building the "Belt and Road" family, and a large number of landmark projects such as China-Laos Railway and Jakarta-Bandung High-speed Railway have been completed and put into operation. This year, the Regional Comprehensive Economic Partnership Agreement (RCEP) came into full force for 15 signatory countries, and China’s Pilot Free Trade Zone has also been upgraded and expanded to 22, and Xinjiang has joined the family of Pilot Free Trade Zones.

Join hands with the world and move towards prosperity. In the first three quarters of this year, the per capita disposable income of Chinese residents reached 29,398 yuan, a year-on-year increase of 5.9%. This year, the results of the third batch of high-value medical consumables and the eighth batch of centralized drug procurement organized by the state have been implemented nationwide, and the overall cost of dental implantation has also dropped significantly. 1-mdash this year; In November, the national tax reduction and fee reduction and tax refund deferral exceeded 1.8 trillion yuan, and taxpayers in the private economy were the main beneficiaries of preferential tax and fee policies, accounting for 73.8%.

This year, the Chinese civilization tracing project released the latest achievements, which deepened the understanding of the origin and early development of Chinese civilization. A breakthrough has been made in the archaeology of Sanxingdui site, and it is estimated that the burial age of six sacrificial pits is concentrated in the late Shang Dynasty and early Zhou Dynasty. The cultural landscape of Pu ‘er Jingmai Mountain ancient tea forest has been listed in the World Heritage List, and the number of world heritage sites in China has increased again … … The splendid Chinese civilization has condensed a strong spiritual force for strengthening cultural self-confidence and building a cultural power.

In today’s China, the people’s better life is constantly realized, the high-level opening-up is promoted vertically, and the international influence is increasing day by day … … Step by step, progress bit by bit, the thriving land of China, vividly shows the vitality and weather of Chinese modernization.

In the first 11 months of this year, the R&D expenditure of central enterprises exceeded 900 billion yuan.

The reporter learned from the State-owned Assets Supervision and Administration Commission of the State Council that in the first 11 months of 2023, the R&D expenditure of central enterprises reached more than 900 billion yuan, an increase of nearly 70 billion yuan.

In 2024, the R&D investment intensity and scientific and technological output efficiency of central enterprises will continue to improve, the overall asset-liability ratio will remain stable, the transformation of traditional industries will continue to be promoted, the construction of 100 digital transformation pilot enterprises and 100 smart factories will be accelerated, and the green and low-carbon transformation in the fields of industry, construction and transportation will be further promoted.

China’s manufacturing production index has been in the expansion range for seven consecutive months.

China Federation of Logistics and Purchasing and National Bureau of Statistics announced today (December 31, 2023) that the purchasing managers’ index of China manufacturing industry in December was 49%. From the main sub-indices, the production index reflecting the product supply of manufacturing enterprises is 50.2%, which has been in the expansion range for seven consecutive months; The expected index of production and business activities reflecting the confidence of enterprises has risen for three consecutive months.

Throughout the year, the economy showed a steady recovery and the structure improved.

According to the annual trend of purchasing managers’ index of manufacturing industry, the annual average value of purchasing managers’ index of manufacturing industry in 2023 is close to 50%, which is 0.8 percentage points higher than the annual average value in 2022, and the economy shows a steady recovery and a good structural development trend.

In 2023, the annual average of purchasing managers’ index of manufacturing industry in China was 49.9%, which was 0.8 percentage points higher than that in 2022. From the trend of the year, the purchasing managers’ index of manufacturing industry ran at a good level of more than 50% in the first quarter, indicating that the economy recovered rapidly after the impact of the epidemic subsided; In the second quarter, the index dropped rapidly, indicating that the economic recovery momentum slowed down after the rapid release of backlog demand; In the third and fourth quarters, the average index was around 49.5%, which showed that China’s economy maintained a relatively stable operation, driven by the active implementation of policies and measures to stabilize the economy and promote growth.

From the perspective of enterprise market expectation, in the second half of 2023, the average expected index of production and operation activities is higher than that in the first half and the second half of 2022, indicating that enterprise confidence is constantly boosting.

Experts said that looking forward to 2024, China has a solid super-large-scale market and strong production capacity advantages, and it is still a vital link in the global supply chain value chain. Various policies and measures to stabilize the economy, promote growth and optimize the structure have continuously achieved results. The foundation for China’s economy to continue to operate well is still relatively solid, and the economy is expected to continue to pick up in 2024.

Eight departments issued the Guiding Opinions on Accelerating the Transformation and Upgrading of Traditional Manufacturing Industry.

The Ministry of Industry and Information Technology and other eight departments recently jointly issued the Guiding Opinions on Accelerating the Transformation and Upgrading of Traditional Manufacturing Industry, proposing that by 2027, the penetration rate of digital R&D design tools and the numerical control rate of key processes of industrial enterprises will exceed 90% and 70% respectively, and the intensity of industrial energy consumption and carbon dioxide emission will continue to decline.

In the first 11 months, the profit of China’s software industry increased by 12.9% year-on-year

According to the data of the Ministry of Industry and Information Technology, in the first 11 months of this year, China’s software business revenue exceeded 11 trillion yuan, showing a rapid growth trend; The total profit reached 1,303.3 billion yuan, a year-on-year increase of 12.9%.

[Great country project highlights China’s strength and adds new kinetic energy to the high-quality development of China’s economy]

This year, new breakthroughs have been made in a series of major projects, from the eastern coast to the northwest inland, from the underground 10,000 meters to the deep blue sea. These landmark achievements reflect China’s increasingly high-spirited innovative ideas and continuous innovation vitality in generate.

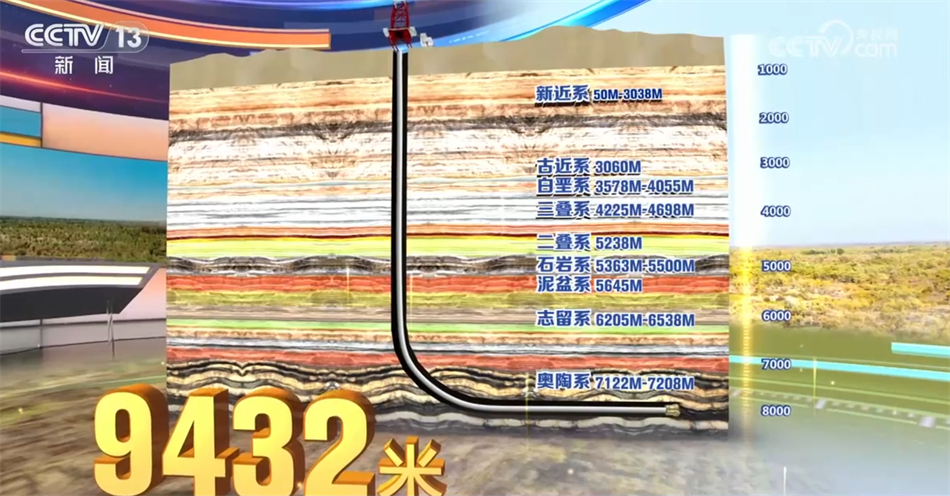

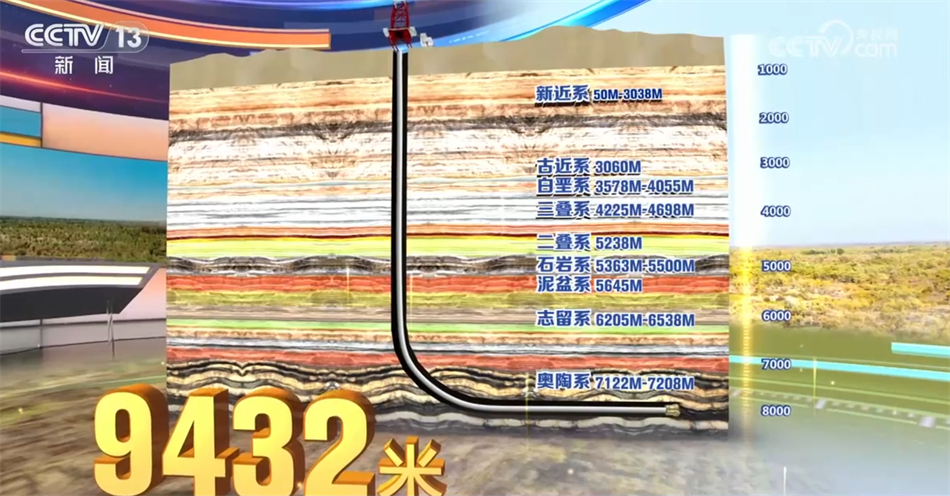

It is 8848 meters above sea level, which is the height of Mount Everest, the highest peak on earth. And if you reverse the direction and extend several kilometers below the ground, what will you find? This year, China found the answer in the Taklimakan Desert in Xinjiang. On November 15th, 2023, the "Shendi No.1" Yuejin 3-3 well located in Tarim Basin, Xinjiang, obtained high-yield oil and gas flow from the well depth of 9432 meters. 9432 meters, the depth of this completed drilling is nearly 600 meters more than that of Mount Everest, setting a new record for the inclined depth of the deepest well in Asia and the horizontal displacement of ultra-deep drilling.

Thousands of meters deep, we found precious "black gold"; Prospering towards the sea, we turn the sea breeze into a surging "blue power". On June 28th this year, the world’s first ultra-large capacity 16 MW offshore wind turbine was successfully hoisted in Fujian. The height of the hub center of this super windmill is 152 meters. It can generate more than 66 million kWh of electricity a year, which is enough for 36,000 households to use electricity for one year. Moreover, all the key components of this wind turbine are made in China.

Ten years of water supply in the first phase of the East Route of South-to-North Water Transfer Project: optimizing the allocation of water resources, more than 68 million people directly benefited.

The South-to-North Water Transfer Project is an important strategic infrastructure to alleviate the shortage of water resources and the deterioration of ecological environment in northern China and promote the optimal allocation of water resources. On November 15th this year, the first phase of the East Route of South-to-North Water Transfer Project was officially opened for the 10th anniversary. In the past ten years, more than 40 billion cubic meters of river water has been pumped, and the population directly benefited from the water receiving area exceeds 68 million.

Major projects are frequently "innovative" to show the hard-core strength of China manufacturing.

Underground exploration, strong to the chart, major projects frequently "new", fully demonstrating the hard-core strength made in China; Crossing mountains and seas to overcome difficulties, the construction of big country projects is constantly adding new kinetic energy to the high-quality development of China’s economy.

The clear waves are vast and turbulent. Major national water conservancy projects — — In 2023, the project of diverting water from the Han River to the Wei River was officially opened to Xi ‘an, with a total water receiving area of 14,000 square kilometers and a population of 14.11 million. The beautiful vision of the Han River flowing through the Qinling Mountains and moistening the land of Qinchuan finally came true.

A bridge flies to build a thoroughfare. Not long ago, the Tianxingzhou special waterway bridge of Changtai Yangtze River Bridge project was successfully closed. With a main span of 388 meters, this waterway bridge is the world’s largest steel truss arch bridge for highway and railway. Changtai Yangtze River Bridge connects Changzhou and Taizhou, Jiangsu Province, with a total length of 10.03 kilometers. It is the world’s first river-crossing passage integrating expressways, intercity railways and ordinary highways.

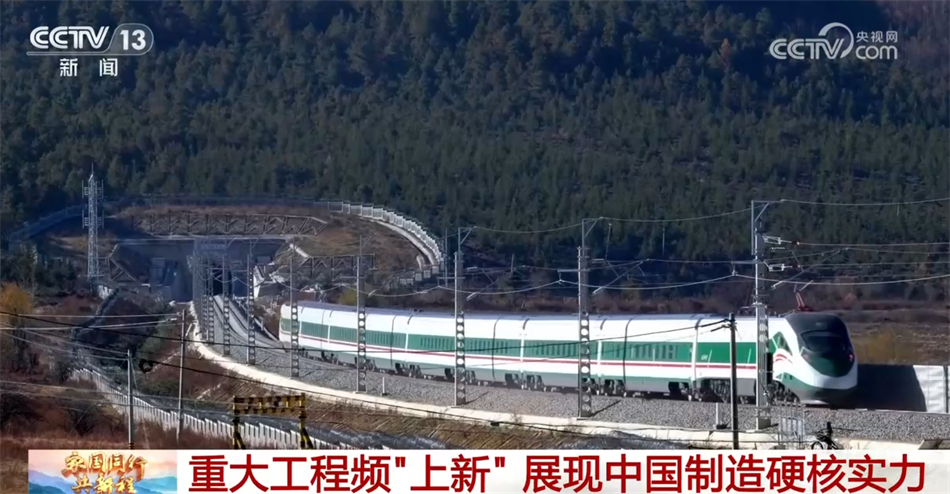

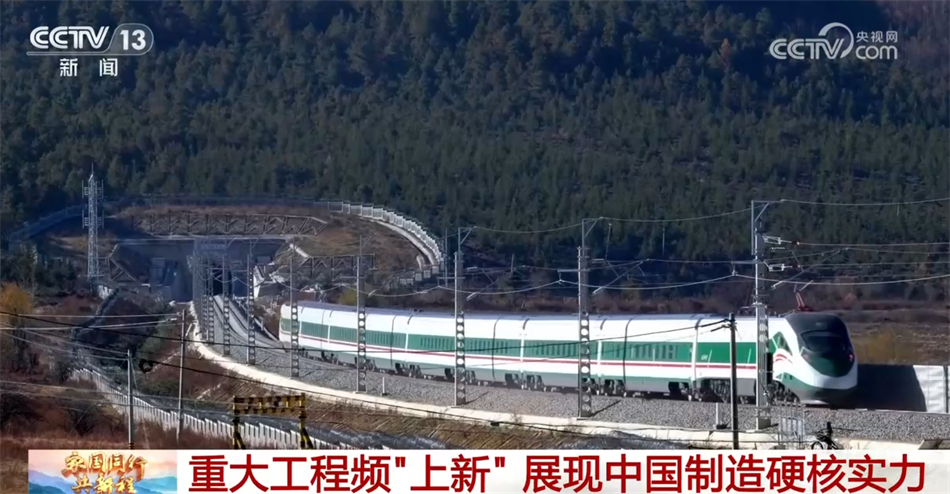

The construction of the great country project not only turns "thousands of miles away" into "close at hand", but also becomes a bond carrying happiness. Yunnan Diqing Tibetan Autonomous Prefecture is located at the junction of Yunnan, Sichuan and Tibet provinces, where many ethnic groups live together. On November 26th, 2023, the Lijiang-Shangri-La Railway was officially opened with the departure of the C 9518th "Fuxing" EMU train from here, which ended the history of no railway in Diqing Prefecture and also set up a bridge for ethnic exchanges and exchanges.

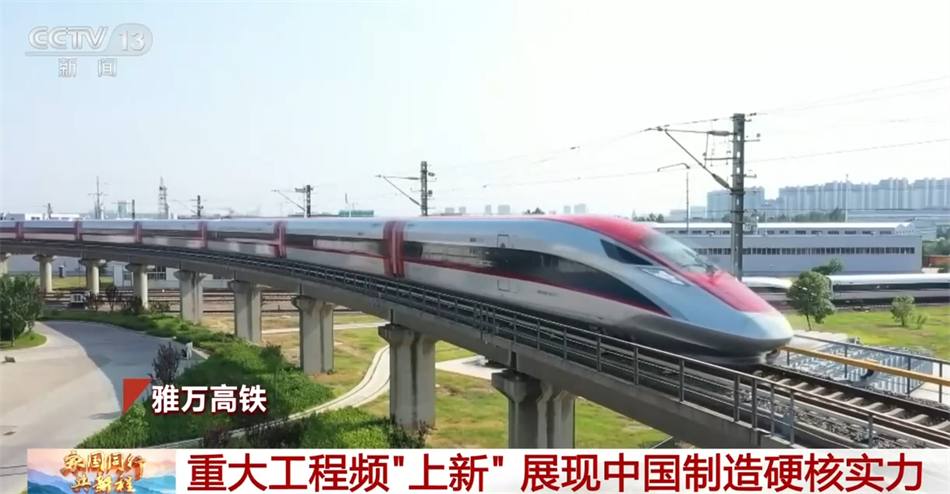

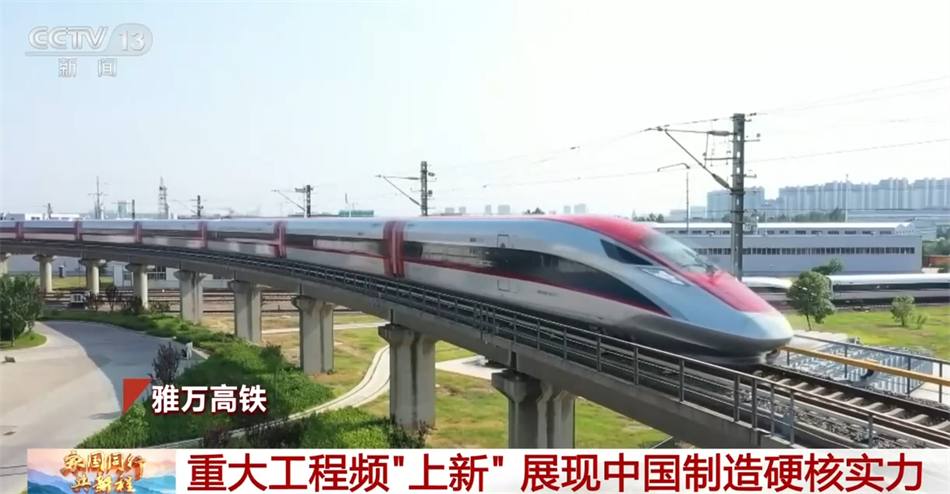

The bridge to people’s hearts also crosses national boundaries. On October 17, 2023, China and Indonesia jointly established a landmark project of "One Belt, One Road" cooperation — — Jakarta-Bandung High-speed Railway officially opened for operation, with a maximum operating speed of 350 kilometers per hour. It is the first high-speed railway in Indonesia and even Southeast Asia. It not only injects vitality into Indonesian development, but also further promotes China’s high-speed rail standards and equipment to the world.

While the traditional infrastructure continues to exert its strength, the new infrastructure has also entered the fast lane. By the end of November 2023, the total number of 5G base stations in China reached 3.282 million, covering all prefecture-level cities and county towns. China 5G is constantly consolidating the infrastructure base for the development of digital economy.

The first batch of units in the largest onshore wind power project are connected to the grid for power generation.

Today, the world’s largest onshore single wind power project — — The first batch of units in the first phase demonstration project of Wulanchabu Wind Power Base will realize grid-connected power generation, with an annual power generation capacity of 3.6 billion kWh, which will effectively promote the development of local green economy.

The first-phase project of Wulanchabu Wind Power Base of State Power Investment has a total installed capacity of 6 million kilowatts, which is located in the central and eastern part of Siziwangqi, Wulanchabu City, covering an area of over 2,000 square kilometers. The installed capacity of the first batch of grid-connected power generation units is 1.2 million kilowatts. After all the projects are put into operation, they can generate 18 billion kWh of clean electricity every year, reducing carbon dioxide emissions by 15.3 million tons.

[A number of initiatives work together to "flow" to highlight China’s traffic strength]

The annual freight volume of the Three Gorges Project reached a new high.

The reporter learned from the Three Gorges Group today that in 2023, the annual freight volume of the Three Gorges Hub reached 172 million tons, up 7.95% year-on-year, a record high. The vitality of the dam passage of the hub was further released, and the shipping benefits of the golden waterway were further brought into play.

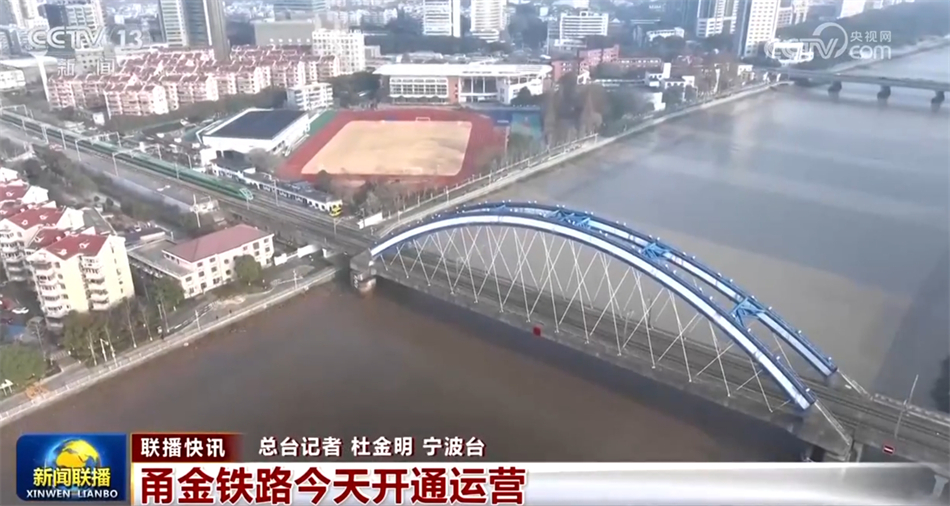

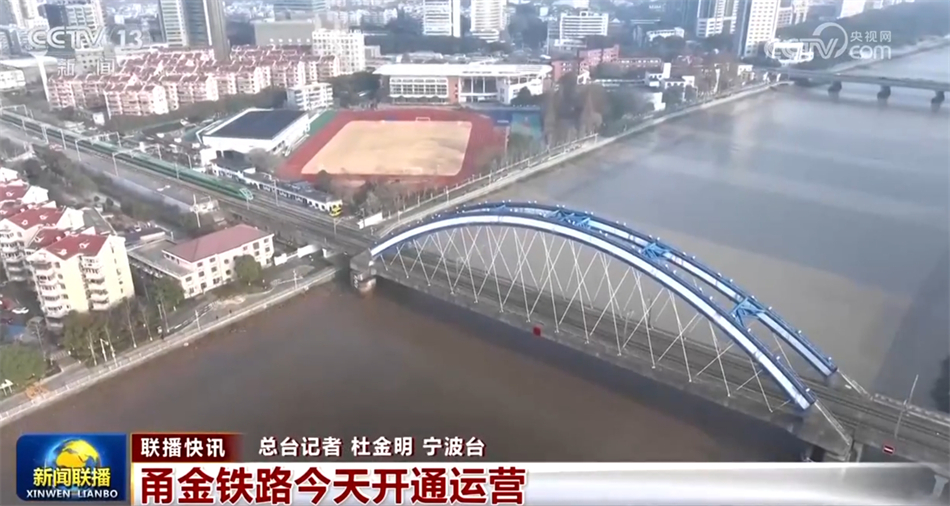

Yongjin Railway opens, Ningbo Zhoushan Port and Yiwu are interconnected.

Today, the Yongjin Railway from Ningbo, Zhejiang Province to Jinhua has been put into operation, with a total length of about 188 kilometers and a design speed of 160 kilometers per hour. There are 9 stations in the whole line, including Fenghua, Shengzhou, Jinhua and Yiwu, realizing the interconnection between Zhoushan Port in Ningbo and Yiwu.

The annual container throughput of Beibu Gulf Port has exceeded 8 million TEUs.

In 2023, beibu gulf port’s annual container throughput exceeded 8 million TEUs, a record high, with an increase of over 10% for seven consecutive years. Up to now, there are 76 routes in the port, which has achieved full coverage of major coastal ports in China and ASEAN countries.

From January 1, 2024, Hainan will collect half of the port charges for goods.

The reporter learned from the Hainan Provincial Department of Transportation that according to the Action Plan for Reducing Fees and Improving Services at Maritime Ports in Hainan Province (2023— In 2025), in order to reduce logistics costs, from January 1, 2024, port operators in Hainan Province will collect cargo port charges at 50% of the national standards. Port dues for goods refer to the fees charged by the port administration agencies for goods handled through the port.

From January 1, 2024, Guangxi Expressway will fully implement differentiated toll collection.

Recently, the Department of Transportation, the Development and Reform Commission and the Department of Finance of Guangxi Zhuang Autonomous Region issued the Work Plan for Implementing Differentiated Toll Collection to Promote High-quality Economic Development in Guangxi Expressway, starting from January 1, 2024 — By December 31, 2026, Guangxi Expressway has fully implemented differentiated charging, and studied and formulated six differentiated charging methods, including sub-payment, sub-entrance, sub-section, sub-vehicle, sub-time, sub-direction and independent pricing. It is estimated that the reduction of vehicle tolls will exceed 2 billion yuan in 2024.

[Accelerate the construction of high-standard farmland to create a "hope field" for rural revitalization]

Gansu built 28.87 million mu of high-standard farmland to help increase grain production.

High-standard farmland is the farmland with concentrated contiguous areas, supporting facilities, high and stable yield, good ecology and strong disaster resistance, which is formed through land consolidation and construction, including land leveling, irrigation and drainage, farmland protection and other projects. By the end of this year, Gansu has built a total of 28.87 million mu of high-standard farmland to promote the continuous growth of grain output.

At present, in the construction site of high-standard farmland in Touqi Village, Hanzuo Town, Liangzhou District, Wuwei, Gansu Province, the staff installed the equipment of "water and fertilizer integrated and efficient water-saving drip irrigation" according to the specifications, which is also the last link in the construction of high-standard farmland irrigation and drainage project this year. After installation, the equipment can be put into agricultural production next spring after debugging and pressurization.

In 2023, 30 mu of cultivated land in Liu Dongsheng, a grower, was used for the first time after being built into high-standard farmland. Although affected by the dry weather, the yield per mu still reaches about 1800 Jin, and in some plots, the yield per mu even reaches 2000 Jin, which is the same as the high yield in favorable weather years.

By the end of this year, Gansu had built a total of 28.87 million mu of high-standard farmland. This year, the province’s grain output reached 12.729 million tons, an increase of 79,000 tons over last year.

Looking back on 2023, every hard-working year and every hard-working moment in the past has been fixed as an unforgettable moment; Looking forward to 2024, every good wish in the future and every hard-working day will mean a brand-new beginning; Landscape Wan Cheng, non-stop. Every drop of sweat is not in vain, and every effort has a harvest; Accompanying each other, home and country walk together. Regardless, every stroke and painting is filled with the spirit of self-improvement; Tick-tock, time continues to move slowly at its own pace. When the sun jumps over the horizon again, we will usher in a new year. The road under our feet has never been a Ma Pingchuan. With full confidence and United struggle, we will stride forward fearlessly.