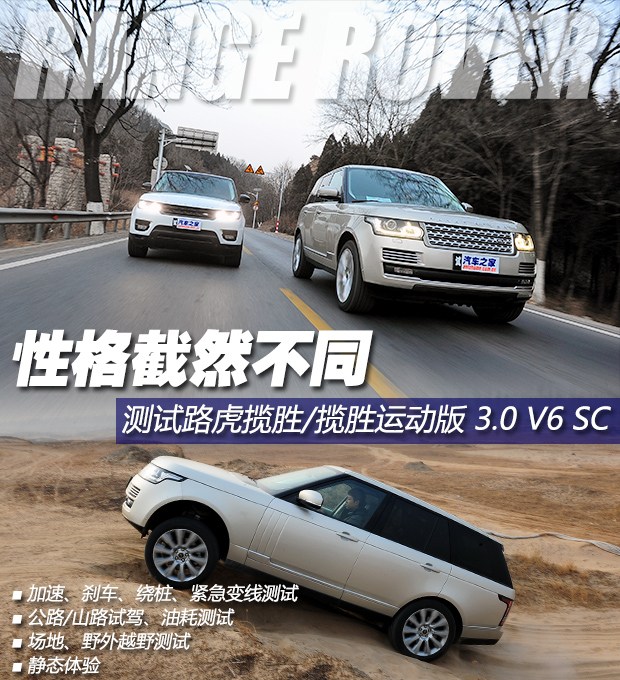

[car home Professional Evaluation] In 1947, Mr. Maurice Vilks had a farm on the Red Wharf Bay Island in Anglesey, and he was very eager to have a multi-functional car with the functions of a light tractor and an off-road vehicle. So he outlined the outline of the car on the beach and solemnly named it "Land Rover". A few years later, Land Rover began to build a brand-new Land Rover with the concept of "leisure and urbanization", and finally created the Land Rover Range Rover series. Today, Range Rover and Range Rover Sport are the most prominent in the Range Rover series. However, with the launch of a new generation of vehicles, the gap between them is gradually narrowing, especially when they adopt the same platform, the same power system and the same aluminum body technology. Can they still have different personalities? Today I will reveal the answer.

● Power system, body structure

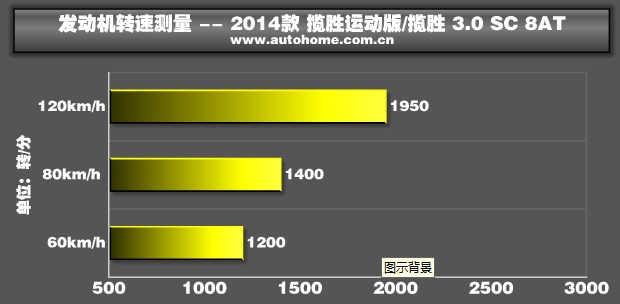

Today, the Range Rover and the Range Rover Sport Edition we invited use the same 3.0-liter V6 SC supercharged engine, which is matched with the 8-speed automatic manual transmission produced by ZF. However, this does not mean that they will have the same driving experience and riding experience, but the focus is on adjustment.

Don’t underestimate this V6 engine, even if it is driving a big guy like Range Rover Sport and Range Rover, its power is very abundant. After re-adjustment by engineers, the maximum power of this 3.0-liter supercharged engine has climbed to 340 HP and the maximum torque is 450 Nm. This data has completely surpassed the 3.0-liter supercharged engines of BMW X5 3.0T and Porsche Cayenne Entry Edition, but BMW X5 and Cayenne have done better in the output range of maximum torque. In addition, the new generation Range Rover Sport Edition with all-aluminum body is lighter than X5 and Cayenne. Theoretically, Range Rover Sport Edition should run faster, and the result is indeed true.

At the moment when the ignition switch is pressed, the two cars show completely different personalities. The exhaust sound of Range Rover Sport Edition is even more shocking. The deep and powerful roar instantly penetrates the air, showing the momentum that a large-displacement engine should have. The restless sound makes it sound more like a performance car, which reflects the positioning of its sport edition. The exhaust sound of Range Rover is much gentler. After all, this is a car that often attends high-end business and administrative occasions. Maturity is its innate temperament.

● Acceleration/braking test, dynamic feeling

Since the Range Rover Sport Edition focuses more on road performance, let’s take a look at its performance in this link. In fact, as early as a few months ago, I personally drove the new generation Range Rover Sport Edition on the country roads in Britain, and I also experienced its powerful four-wheel drive performance in the world’s largest Land Rover Off-road Experience Center. Unfortunately, the V8 and V6 diesel versions were tested at that time, and the strong power performance was self-evident. Today, the power combination of V6 supercharged gasoline engine +8AT still doesn’t disappoint me. Although the power reserve of V6 engine is not as sufficient as that of V8 during daily driving, thanks to the quick response of 8AT gearbox, its overall performance still exceeds my expectations. Whether it is accelerating at the start or accelerating in the middle, the performance of this engine is unambiguous, which is more than enough to push these two big guys.

■ 0-100km/h Acceleration Test: Range Rover Sport Victory

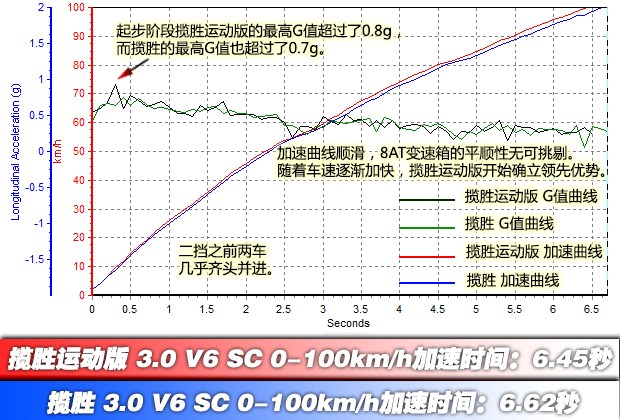

The specific strength can only be known through actual tests. We have carried out several 0-100km/h acceleration tests on the two cars respectively, and finally the Range Rover Sport Edition won the first prize with a slight advantage of less than 0.2 seconds with better body posture, smaller wind resistance and lighter curb weight at the start. Both cars are much faster than we expected, and the official acceleration results are too conservative (the official 0-100km/h acceleration of Range Rover Sport Edition is 7.2 seconds, and the Range Rover has not been announced).

In the initial stage, the gearbox limited the torque output, and at the same time, the accelerator and brake pedal were deeply stepped on, and the rotation speed of both cars was maintained at 2500rpm. When the brake pedal is released, the four-wheel drive system distributes the power to the four tires reasonably. During the whole process, the tires hardly slip, and the two behemoths come out like shells. The longitudinal G value of the Range Rover Sport Edition has exceeded 0.8g, and the Range Rover has also exceeded 0.7g..

However, after the start, the acceleration process of the two cars began to become dull. Even in such a rapid acceleration process, the 8-speed automatic gearbox from ZF was not violent, and every shift in the red line area of 6500rpm was still smooth, which would lose some fun, but ensured good ride comfort.

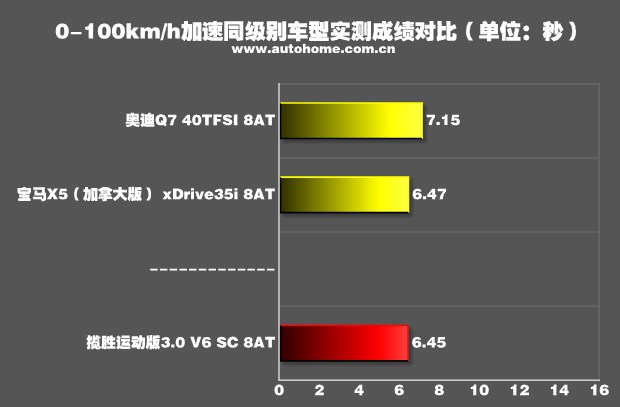

■ Accelerated comparison between Range Rover Sport Edition and its peers.

Although this huge SUV has excellent acceleration ability, it is difficult for people to feel the pleasure of flying close to the ground. It was not until the moment I read the test results that I realized that these two guys were running so fast, and the Range Rover Sport Edition has already overwhelmed the new generation BMW X5 Canada Edition (test link) that we just tested, becoming the fastest player of this level and this displacement. As for the Range Rover, because it has no clear competitors, the "acceleration and brake comparison at the same level" naturally has nothing to do with it.

By the way, since two 3.0 SCs are already so fast, is it necessary for consumers to consider the 5.0 SC version with higher displacement? My answer is: yes! Because compared with this V6, the surging power of that V8 can be improved a little bit, and there is no need for the gearbox to downshift when accelerating rapidly. That kind of carefree feeling is only known after trying.

■ 100-0km/h brake test: Range Rover Sport wins.

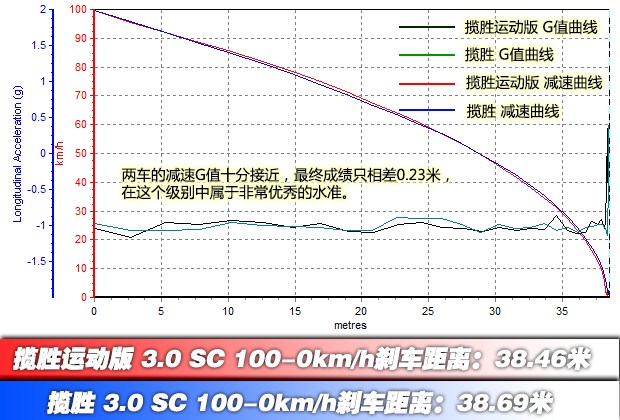

In the brake test, the results of the two cars are also very close, and the curves are almost coincident. Even the Range Rover with higher body and softer suspension shows a solid and stable foundation. The measured result of 38.69 meters is absolutely excellent for such a huge SUV, while the Range Rover Sport Edition is even better.

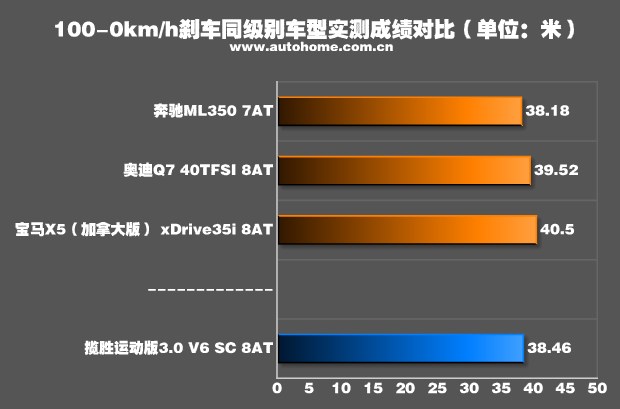

Compared with competitors of the same level, the measured braking performance of Range Rover Sport Edition at 100-0km/h is second only to Mercedes-Benz ML350. Looking at the many million-class SUVs that have been tested before, their performance in braking is not disappointing.

■ Actual power feeling: Range Rover is comfortable, Range Rover Sport Edition is direct.

Although the acceleration performance of Range Rover Sport Edition is similar to that of Range Rover, the two cars are quite different in terms of driving experience. The accelerator pedal adjustment of Range Rover Sport Edition is extreme, and the speed pointer can make a quick response when stepping on the accelerator. When accelerating rapidly, the gearbox can quickly downshift to ensure strong torque output. In short, its throttle response is very positive, which requires the driver’s more delicate footwork. With the exciting exhaust sound, the Range Rover Sport Edition can give the driver a strong driving pleasure.

Range Rover, on the other hand, is completely opposite. In order to emphasize more comfortable driving experience, engineers deliberately adjust the throttle slightly slowly, and need deeper pedaling action to get the same power output as Range Rover Sport Edition, which will obviously greatly reduce the driving pleasure of Range Rover, but it also brings more comfortable riding experience. In short, there is absolutely no impulse to race with others when driving a Range Rover, and the VIPs in the back can also enjoy the pleasant journey to their heart’s content.

From beginning to end, the performance of this 8AT gearbox is conscientious, and the ride comfort during daily driving is almost impeccable. When accelerating rapidly, it will also make a downshift at the first time. Because of the different positioning of the two cars, the designer finally equipped the Range Rover Sport Edition and Range Rover with different types of shift operating mechanisms, among which the Range Rover Sport Edition is an electronic gear lever, and the Range Rover is a knob shift, and the shift paddles also appeared in the two cars we tested.

There is little difference in the strength adjustment of the brake pedal, and the biggest difference in braking feeling comes from the different body heights of the two cars. According to official data, the height difference between the two cars is 55mm, but the subjective feeling of sitting in the driver’s seat is even greater than this difference. Range Rover’s tall body and soft suspension make the center of gravity of the vehicle shift more obviously when braking, and there will be some fear in my heart when driving for the first time, but fortunately, the braking strength of the two cars is very uniform and linear, and it can be reliable at critical moments.

Summary of daily driving experience:

Although the acceleration and braking performance of the two cars are similar, the overall feeling of the accelerator and brake pedal to the driver is obviously different. Range Rover Sport responds more directly, stepping on the pedal will react immediately, while Range Rover is a little slow, mainly to emphasize comfort.

● Chassis feeling, pile winding test and emergency line change test

After different adjustments, the air suspension also shows a completely different personality. The suspension of Range Rover Sport Edition is much tougher than that of Range Rover Sport Edition, and it will give people more confidence when cornering at high speed. However, the adjustment of Range Rover’s obvious preference for comfort makes it a little overwhelmed, but its performance in filtering road bumps, especially in speed bumps, is far better than that of Range Rover Sport Edition.

■ Pile winding test: Range Rover Sport Edition performs better, but it is greatly influenced by electronic stability program.

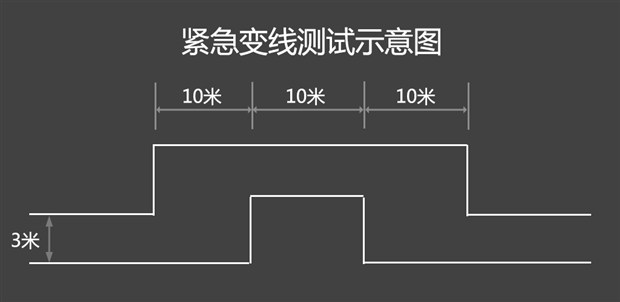

Many people don’t think it is necessary to test the SUV around the pile. In fact, they also have to face the winding Panshan Road when driving on the same road, and they also need to make hedging actions in an emergency, which is precisely their weakness. We carried out an 18-meter pile winding and emergency parallel test on two SUVs. One is to see if there is a gap between the two cars in sports performance, and the other is to show the performance of the two cars in the face of emergency, so that car buyers can know fairly well.

Range Rover Sport Edition is slightly better than Range Rover in restraining body roll, and the steering wheel’s directivity is much clearer. However, its body stability control system can not be completely closed, and the intervention point is earlier and the intensity of intervention is stronger than that of Range Rover. In the process of winding piles, every time the limit is approached, the electronic stability system will intervene with great strength, and it is difficult to test the winding piles smoothly. However, for the safety of daily driving, the caution of the electronic system is also understandable.

In contrast, Range Rover’s soft suspension and tall body make its posture around the pile very awkward, and the huge shift of center of gravity brings great pressure to the suspension of the left and right front wheels, which also makes the driver feel a little overwhelmed and understeer is very serious. Even if the body stability control system is turned off manually, it will jump out and take the initiative to intervene when necessary, but the electronic system intervention of Range Rover is softer than that of Range Rover Sport.

"The above video shows the performance test and pile winding performance of Range Rover Sport Edition."

"The above video shows the performance test of Range Rover and the performance around the pile."

More exciting videos are all on the car home video platform.

■ Emergency line change test: electronic stability system plays the leading role, and the advantages of Range Rover Sport Edition are difficult to play.

In addition to the pile-winding test, we also made an emergency lane change test comparison between the two cars. The emergency lane change test examines the vehicle’s ability to avoid obstacles while traveling. Because the centers of gravity of Range Rover Sport Edition and Range Rover are relatively high and the width of the test site is limited, based on the principle of safety,We tested the two cars at a speed of 60 km/h. During the whole test, the driver did not touch the accelerator and brake pedal, and the electronic stability control system was on.

Range Rover Sport Edition has better directivity when hitting the direction, and the driver can basically feel the direction that the car body is going to travel. The control of the body posture is in place, although there is also understeer, but the response of the front is still timely. Speaking of this, the performance of Range Rover Sport Edition is better than that of Range Rover, but at this time, the electronic stability system intervened again and braked the wheels vigorously, so from the video, the Range Rover Sport Edition passed more reluctantly.

When the Range Rover entered the first corner, it was quite awkward. The fuzzy directivity made it difficult to grasp the direction of the vehicle. At this moment, the Range Rover did not point to where to drive, but the driver needed to improvise according to the direction of the front of the car. The driver must make a prediction in advance, because the response of the front of the car is always half a beat slow, and the phenomenon of understeer is more serious. Fortunately, the electronic system intervention of Range Rover is not as abrupt as the Range Rover Sport Edition, and the driving rhythm will not be seriously disrupted.

More exciting videos are all on the car home video platform.

● Mountain Road Test Drive: Range Rover Sport Edition has obvious advantages.

In order to further experience the difference between the two cars on the pavement, we came to a mountain road. Because this Range Rover Sport Edition has no dynamic driving mode (only available in the 5.0 V8 SC model) and has no dynamic active rear axle limited slip differential, its driving pleasure will be greatly reduced compared with the V8 version. Even so, driving this Range Rover Sport Edition on a mountain road is much more leisurely than Range Rover. If the full road condition feedback system is set to highway or AUTO mode, the air suspension will be automatically adjusted to the most suitable height and hardness to ensure a more stable performance when cornering. Sensitive accelerator pedal and crisp shifting action will enhance the driver’s confidence.

If you want its dynamic response to be more positive, then shift into the S gear, and the gearbox will delay the upshift, so as to ensure that the engine has the most abundant dynamic performance. At this time, any slight action you apply to the throttle will stimulate it, and the slightly heavy steering direction is better than the Range Rover. If it’s not fun enough, you can also get excited for a while by turning the shift paddle behind the steering wheel, quick response and large gear font on the dashboard. Of course, don’t expect too much from the handling of the Range Rover Sport Edition. After all, it’s just an SUV, and its bending ability can’t be compared with that of a sports car.

Being in the Range Rover, the whole person becomes nervous instantly, and you will feel that you are driving a monster at this time. Yes, you will feel this way when driving a Range Rover. Perhaps many people think that Range Rover is irreplaceable because they like the feeling of being above others. Unfortunately, I am not interested in it. The winding mountain road is a nightmare for Range Rover. Although the support strength of the rear suspension is strong enough, the overall soft adjustment will still make the driver’s palm sweat. The slightly slow adjustment of the accelerator pedal will also seriously damage the driver’s mood here, because its rhythm will always be half a beat slower, thus affecting the driver’s judgment on the corner. I don’t think anyone here will miss the feeling of driving like a luxury yacht, not to mention the thoughts of the back passengers swaying left and right at the moment. As for the shift paddles, I have no scruples, and it doesn’t mean much whether the shift paddles appear or not for this comfortable model.

● Fuel consumption test: Range Rover Sport wins

Consumers who buy Range Rover or Range Rover Sport Edition may not care too much about the average fuel consumption of these two cars, because local tyrants will never be stingy with that oil money. On the contrary, for onlookers, I’d like to see how amazing these two cars will be in this link. During the whole fuel consumption test, we experienced various road conditions, such as mountain roads, expressways, urban loops and congestion. Each car has three passengers. The final measured comprehensive fuel consumption of Range Rover Sport Edition is 15.52L/100km, and the comprehensive fuel consumption of Range Rover is 16.07L/100km, which is higher than the average fuel consumption displayed by the driving computer. Among them, mountain roads and city streets are relatively oil-consuming sections. Generally speaking, the fuel consumption results of the two cars are in line with my expectations.

Summary of chassis handling:

Through the test drive on the mountain road, we found that the chassis suspension of Range Rover Sport Edition is tougher and the cornering posture is better, and the feedback strength of the steering wheel and the directivity of the front of the car also reflect the sports characteristics. On the contrary, Range Rover is obviously inclined to comfort, with soft suspension and fuzzy direction, which is not suitable for intense driving on mountain roads. However, there is not much difference in the speed of the two cars in the limit state in the actual tests of winding piles and emergency lane change. In other words, there is no obvious difference in handling between the two cars from the outside, which is mainly because the electronic stability system of Range Rover Sport will cause too much interference to the driver, resulting in its failure to exert its full limit.

● Four-wheel drive structure: basically the same.

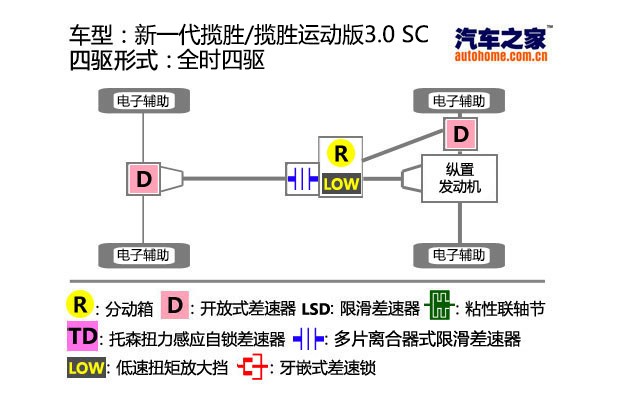

As we all know, both Range Rover Sport Edition and Range Rover are equipped with full-time intelligent four-wheel drive system and powerful second-generation all-terrain feedback system. Users only need to choose the corresponding driving mode and control the throttle and direction, and the next difficulties and obstacles will be fully handed over to the vehicle itself to overcome. It’s like a fool’s camera. Even if you don’t know how to take pictures, you can still take wonderful pictures. However, do you know what kind of complicated four-wheel drive structure is hidden under this seemingly stupid operation knob?

"The Range Rover and Range Rover Sport Edition of this test drive all adopt this four-wheel drive structure."

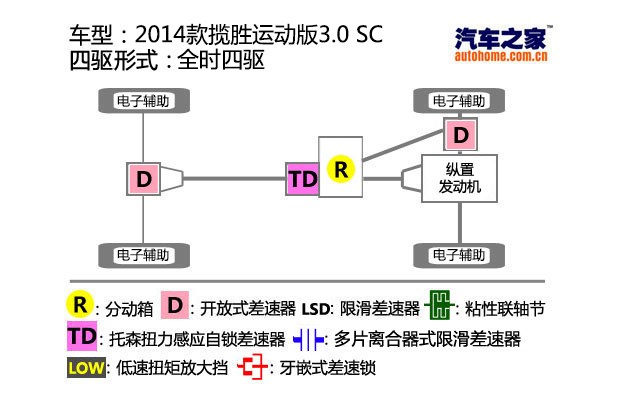

First of all, let’s look at the Range Rover Sport Edition. It can be equipped with two full-time four-wheel drive systems. The central differential with strong off-road capability is a multi-plate clutch structure with low gear. By default, the system distributes the torque evenly in the ratio of 50: 50. According to the change of the combination of multiple clutches, the power distribution of the front and rear axles can be 100% respectively, and the electronic traction control system will also play an auxiliary role. Low gear ensures excellent off-road ability, and can provide 2.93:1 driving force at low gear.

"Range Rover Sport Edition can also be equipped with a four-wheel drive system with single-speed transfer case and +Torsen central differential structure."

The weak four-wheel drive system adopts the structure of Torsen central differential, and there is no low gear. The mass of this system is 18kg lighter than that of the previous system, and the ratio of front and rear torque distribution is 42: 58 by default. The setting slightly biased towards the rear drive aims to improve its driving pleasure. At the same time, in order to ensure off-road performance, according to the different road conditions and grip, Torsen differential can adjust the maximum distribution ratio of front and rear wheels to 62% and 78% respectively. Theoretically, this system is weaker than the first one in four-wheel drive performance.

The Range Rover adopts the first four-wheel drive system, and the two cars we tested this time also use this four-wheel drive system. It is worth mentioning that the above is only the middle part of the whole four-wheel drive system. In fact, in order to further optimize the traction and stability under extreme road conditions, consumers can also choose models with dynamic active rear axle limited slip differential (including Range Rover and Range Rover Sport Edition). The rear axle differential lock will form a powerful four-wheel drive system together with the first four-wheel drive system mentioned above.

The new generation of Range Rover Sport Edition really makes people sit up and take notice. A few years ago, it was the young boy who was on the same platform as the discovery, but hung the name of Range Rover. Now he has truly shared the resources with his eldest brother Range Rover. The same development platform also uses an all-aluminum body, and the power system and four-wheel drive structure are exactly the same as Range Rover. Not only that, the new generation Range Rover Sport Edition has added another option in the four-wheel drive system. From this point of view, Range Rover Sport Edition has integrated most of the advantages of the new generation Range Rover, and the price is so much cheaper than Range Rover. Is there a sense of value?

● Cross-country test

■ Field test: Range Rover has better passability and stronger electronic slip limit between wheels.

However, the theory is a theory after all. Even though the bones of the two cars are almost the same, from the actual off-road test, the Range Rover Sport Edition still has to admit defeat in front of Big Brother. First of all, in terms of hardware indicators, Range Rover Sport Edition is inferior to Range Rover in terms of maximum ground clearance, approach angle and wading depth. In addition, in the face of difficult off-road tests, Range Rover will be more calm, while Range Rover Sport will be inferior. Please read on if you don’t believe me.

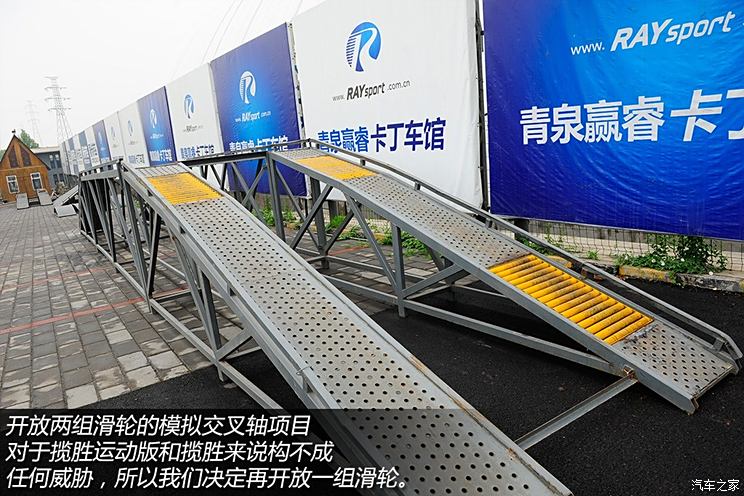

Next, let’s drive the shelves of two cars separately to see their respective performances. First of all, we opened two pulley blocks, the left front and the right rear, to simulate the situation of cross shafts. As expected, this project does not pose any threat to these two cars at all, and the whole process is very easy. So we decided to open another set of pulleys to see if the two cars can pass the test smoothly when only one tire has grip.

As a result, the Range Rover is still very calm. Even if this car is not equipped with an active rear axle differential lock, after choosing the low-speed four-wheel drive mode, with the powerful electronic auxiliary system, the ability to limit slip between the left and right wheels of the Range Rover is still very strong. When passing through the pulley block slowly, the wheels located in the pulley block will be firmly locked by the electronic system after a short slip, and the left rear wheel will get enough power to help the vehicle pass through the pulley block smoothly.

The calm performance of Range Rover made me look forward to the Range Rover Sport Edition. I thought that the Range Rover Sport Edition with the same power system and four-wheel drive system could also perform easily, but the result was not the case. For the first time, when three wheels touched the pulley block at the same time, it failed because the electronic system was not involved in time.

So we decided to start over. The second time, when the vehicle went to the pulley block, the situation was still the same. The electronic system only successfully locked the left front wheel, while the two wheels on the right kept idling. No matter how the driver stepped on the accelerator, the engine could not transmit strong power to the left rear wheel, and the vehicle still could not move. Not only that, because the two wheels on the right side have been idling, and the left front wheel has no adhesion, the whole car body can easily rotate clockwise around the left rear wheel, thus deviating from the driving track. After two failures, the Range Rover Sport Edition finally succeeded in the third challenge. Overall, the whole process is not as easy as Range Rover.

"The above video shows the four-wheel drive performance of Range Rover venue"

"The above video shows the four-wheel drive performance of Range Rover Sport."

More exciting videos are all on the car home video platform.

Since the same power system is adopted, why do the two cars have different performances when facing three open pulley blocks? I’m afraid the reason is that the two cars have different settings for electronic auxiliary systems. During this test, we can clearly feel that the electronic auxiliary braking of Range Rover is very timely and accurate. The Range Rover Sport Edition is a little hesitant, and the braking force is not enough and the power distribution is not accurate enough. This is probably related to the positioning of the two cars. After all, the Range Rover Sport Edition is more focused on road handling. Under the premise of not affecting safety, the vehicle gives the driver more freedom, so it is not difficult to understand that the timeliness of electronic system intervention is not as good as that of Range Rover.

■ Field test: Range Rover is easier for the same project.

The excellent performance of Range Rover in the above site test is obvious to all, and the Range Rover Sport Edition barely passed the test despite some difficulty in climbing when facing three pulley blocks on the slope. However, what will happen to the two cars when they really arrive in the suburbs?

It has been proved that in daily use, 99% of the road conditions that this Range Rover can pass can also pass this Range Rover Sport Edition, but it is not as easy as Range Rover when facing some difficult obstacles. The main reason is that the effective stretching and compression stroke of Range Rover Sport Suspension is not as good as that of Range Rover Sport Suspension, and another reason, as analyzed in the field test section, the involvement degree of electronic auxiliary systems of the two cars is also different.

Summary of cross-country test:

Although both cars finally passed our site test and field test, from the whole process, Range Rover Sport Edition is obviously not as easy as Range Rover. This is mainly because the electronic system of Range Rover Sport Edition can’t take timely and effective braking when it detects tire slippage. On the contrary, Range Rover is more "old-fashioned" in the distribution of four-wheel power. The suspended or slipping wheels get strong braking, and the power is transferred to the needed wheels, so it is much easier to pass the same project.

"The above video shows the cross-axis performance of Range Rover."

"The above video is the cross-axis performance of Range Rover Sport Edition."

More exciting videos are all on the car home video platform.

● Static experience

■ Appearance part

After introducing the performance part, let’s look back at the static performance of the two cars. To tell the truth, I didn’t realize the difference in size between the two cars these days when I was driving them alone. However, when I put the two cars together, the powerful gas field of Range Rover suddenly appeared. At this time, the Range Rover Sport Edition stood by like a young lad, and the two cars seemed to represent different ages of life. The Range Rover Sport Edition was young and green, while the Range Rover was so mature and steady. For Chinese people who always like to be beautiful, the sense of glory brought by Range Rover is incomparable to the Range Rover Sport Edition.

In addition to the size, in the design of details, Range Rover Sport Edition and Range Rover also show different personalities. Although the new generation Range Rover Sport Edition and Range Rover have similar results in the design of headlights, the internal structure of xenon headlights and the light band shape of LED daytime running lights are almost the same, but the headlights of Range Rover Sport Edition are flatter and match with the black mesh (the Dynamic version uses a more cool black mesh, while other versions use a silver mesh), and the overall effect is quite sharp. On the Range Rover, these elements have been pulled up and enlarged, the wide silver mesh is full of domineering, and the headlights with larger sizes also make it look full of energy. In addition, different styles of front bumpers are also in line with the respective positioning of the two cars, one is sporty and the other is administrative.

Range Rover Sport Edition Range Rover

Viewed from the side, the new generation Range Rover Sport Edition has brighter lines, and its drag coefficient has been reduced to 0.34, which will be very helpful for reducing fuel consumption. In addition, it also has a lower roof (94mm lower than the previous generation) and an inclined roof contour, which is the most sporty SUV in the Land Rover family so far. In contrast, the Range Rover is more solemn and the body lines are more capable. The classic shark gills air guide holes have been sealed in this generation of cars, just to preserve the classic elements.

In order to maximize the personalized choice of vehicles, the new generation Range Rover Sport Edition and Range Rover both provide users with a series of aluminum alloy rim customization options ranging from 19 inches to 22 inches, and consumers of Range Rover Sport Edition can also choose red Brembo brake calipers. The two 3.0L V6 supercharged vehicles we test drive use Pirelli SCORPION VERDE tires with the same specifications of 275/45 R21, which is an SUV tire more suitable for driving on ordinary roads.

Range Rover Sport Edition Range Rover

The rear of the car is the biggest difference in appearance between the two cars. The Range Rover Sport Edition draws more lessons from the design style of Aurora. The small and square taillights have a flying wing extension, which echoes the headlights from a distance. In addition to this feature, the taillights of Range Rover still continue the tradition of vertical taillights and have a typical British style. In addition, the design of the rear bumper of Range Rover Sport Edition is not brilliant, perhaps to ensure a good departure angle and thus sacrifice a more sporty visual effect. On the contrary, Range Rover’s hidden tailstock is in line with its own positioning.

● Interior experience

In order to better show the different styles of the two cars, we will introduce the interior part separately.

■ Range Rover Sport Interior Experience

Entering the car, the orange and black interior used in the Range Rover Sport Edition can make people excited. The gray panels, chrome decorative strips and aluminum pedals under the center console and the air outlet of the air conditioner all set off the positioning of the sports version. In recent years, the brand-new interior style of Range Rover family is to reduce the number of keys and knobs as much as possible, and create a luxurious effect in a concise way. Therefore, the interior lines of Range Rover Sport Edition are not complicated, but the sense of science and technology is not inferior at all.

The 8-inch central control display screen and the 12.3-inch full LCD instrument can display extremely rich contents, and their functions and sense of technology are not inferior to those of several German luxury brands. On the whole, this touch-control in-vehicle infotainment system has left a deep impression on me in two aspects. First, it can display the motion state of the vehicle in detail, which is particularly useful when off-road. Secondly, its interface design is very user-friendly. Although its functions are complicated, it is not difficult to get started.

The three-spoke steering wheel feels a little hard, and the friction is relatively large. It only takes 2.75 laps to fill it from left to right, which is in line with the positioning of Range Rover Sport. In addition, the Range Rover Sport Edition has greater steering feedback at high speed and more accurate directivity than the Range Rover, which has been introduced in the previous driving session.

The comfort of the front and rear rows is basically satisfactory, and the seat does not blindly pursue softness and comfort. After all, its name is "Range Rover Sport Edition", so wrapping must also be paid attention to. The two 8-inch screens in the back row are not a bright spot for luxury cars, but the two screens of Range Rover Sport Edition and Range Rover are connected with the entertainment system in the front row, and passengers in the back row can directly select their favorite programs through the remote control.

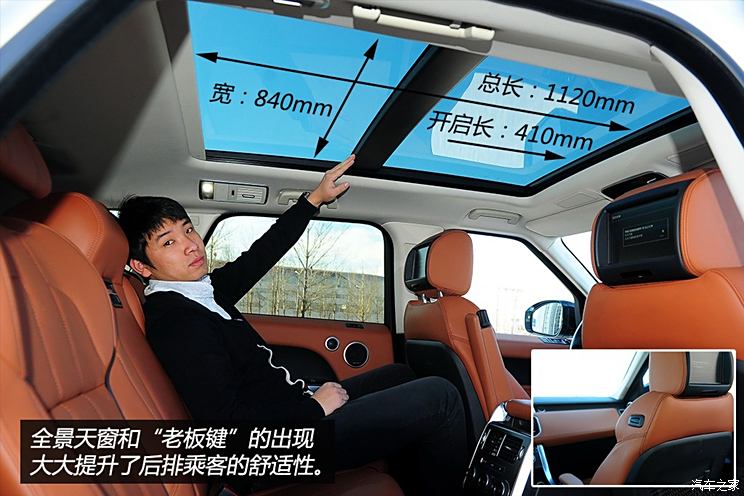

In addition, Range Rover Sport Edition and Range Rover are also equipped with a panoramic sunroof of the same size, which is necessary for this luxury SUV.

■ Range rover interior experience

Because the interiors of the two cars share most parts, but the styles and local details are slightly different, we will not repeat what we have experienced before in the next part of introducing the interior of Range Rover.

Range Rover and Range Rover Sport Edition adopt almost the same central control line design, regardless of the overall color matching of Range Rover and the pattern of decorative plates, the interior becomes more calm, commercial and looks more luxurious. Range Rover’s four-spoke steering wheel is larger in size and turns more than Range Rover Sport Edition, which also leads to fuzzy steering feel. However, the leather steering wheel of Range Rover has a good grip, and the leather on the surface is delicate and soft, which makes people fondle it.

Whether it is front row comfort or rear row comfort, Range Rover is higher than Range Rover Sport Edition. Its seat is spacious and soft, especially the headrest is fresh in people’s memory. My colleague once described it as "D cup" in the previous test drive article of Range Rover, which shows the comfort. In addition, the front and rear seats of Range Rover are more functional than the Range Rover Sport Edition. The front row can be equipped with seat massage function, and the rear row supports electric backrest angle adjustment, so long-distance travel is no longer tiring.

■ Night atmosphere lamp

Do you still remember the seven colors of ambient lights that come with Mercedes-Benz S-Class cars? Land Rover’s engineers are even crazier than Mercedes-Benz. They have provided 10 colors of interior ambience lights for the new Range Rover at once, and they can also adjust the light and shade, but these ambience lights are not available in the Range Rover Sport Edition.

■ Automatic parking

Land Rover’s first car with automatic parking function was Aurora, and now the two big brothers in the Range Rover family, Range Rover Sport and Range Rover, have finally joined this function. After the actual experience, the automatic parking function of the two cars is very easy to use, the monitoring ability of the sensor is very strong, and the rear of the car can be accurately detected, and finally the vehicle stops very straight. It would be better if the forward parking and warehousing function could be added in the future.

● Comparison of ride space

■ Range rover sport edition

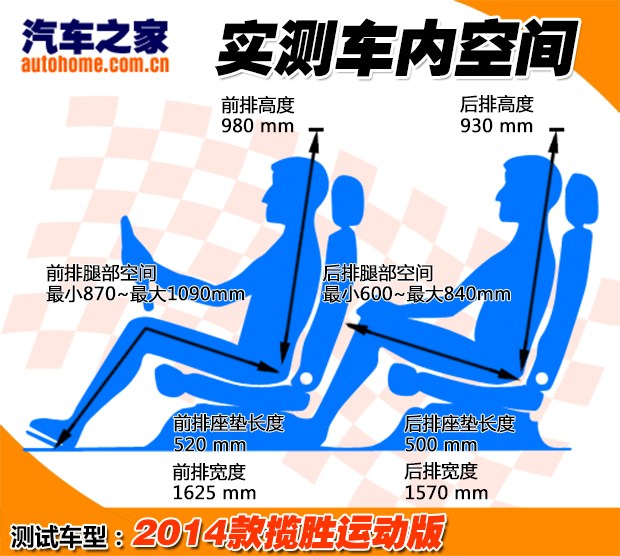

For a medium and large SUV, the space performance of Range Rover Sport Edition is not satisfactory. The experiencer with a height of 182cm sits in the back row with only one punch in his leg space, which is unacceptable to many domestic consumers.

■ visit/tour scenic spots

Because the length and height of the car body have advantages, the ride space of Range Rover is more spacious than that of Range Rover Sport Edition, but the back leg space of the experiencer is still only one punch and three fingers.

● Storage space

Before introducing the storage compartment, it is necessary to show you the refrigerator in the central armrest box. The volume of this refrigerator is not small. It can refrigerate four bottles of mineral water and meet the needs of four passengers in the car at the same time in hot summer.

Other storage spaces of Range Rover Sport Edition are more conventional, and the quantity can fully meet the needs of most people. Unfortunately, neither car is equipped with a glasses case.

Most storage compartments of Range Rover are the same as those of Range Rover Sport Edition, but in addition, it also has some storage compartments, which makes more rational use of the interior space. For example, its front door is designed with an umbrella slot, and the central control glove box is also divided into upper and lower floors.

● Trunk

The trunk of the Range Rover Sport Edition is very neat and bulky. There are four sliding hooks on the floor. If there is a net bag, it can be fixed, so as not to let the easy-to-roll objects run around.

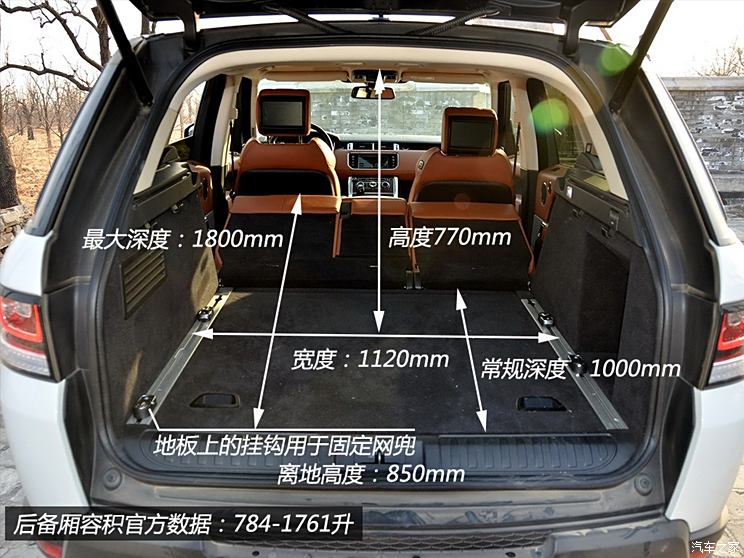

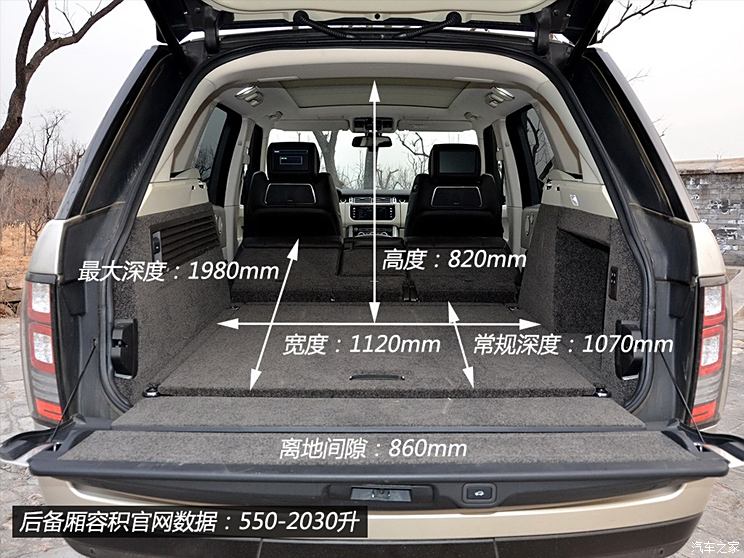

The trunk of Range Rover adopts a more fashionable and practical design of up-and-down door opening, and the rear seats can be controlled to be folded or laid down by pressing buttons. According to our measured data, under normal conditions, the trunk volume of Range Rover is larger than that of Range Rover Sport Edition, but the official data is that Range Rover Sport Edition is larger.

● Full text summary:

As mentioned in the article, the new generation Range Rover Sport Edition has indeed undergone a radical change. It is not only more amazing in appearance and interior, but also has a qualitative leap in driving quality due to its brand-new development platform, all-aluminum body and brand-new power system. However, even so, the future pressure of Range Rover Sport Edition is still very great. After all, the opponents at this level are very strong, and the scene of competing for hegemony will intensify. If you want to win in this war, it is not enough to rely on the product itself.

On the contrary, the future of Range Rover may be easier. It has comfortable driving experience, strong off-road performance, and most importantly, it has a domineering king atmosphere. Its image has long been deeply rooted in the hearts of local tyrants, so even if the price is expensive, some people will be willing to pay for it.

Frankly speaking, after a detailed evaluation and experience, I still haven’t given a clear win or loss in my mind about the two cars in front of me. After all, they are not competitors themselves, and the purpose of this comparison is only to prove that as two top models of Land Rover, what is the connection between them and what is the difference. As it turns out, under almost the same power system, the two cars still show completely different personalities through different adjustments. One is an expert on the road, and the other is a king in cross-country; One is an athlete galloping in the mountain road, and the other is an elite attending the business club. Although manufacturers have been promoting that they are all-around players in SUVs, it turns out that no car can be truly all-around. When two contradictory things are combined, one party will always make a compromise. If we put aside the perceptual factors, only from the technical content of the two cars, the gap between them is not much, and the difference of 610 thousand yuan is indeed somewhat inflated. (Text/Figure car home Zhang Ziyi)